The Basic Principles Of Unicorn Financial Services

Wiki Article

Home Loan Broker Melbourne for Beginners

Table of ContentsGet This Report about Melbourne Mortgage BrokersExcitement About Mortgage Broker In MelbourneOur Loan Broker Melbourne IdeasMelbourne Broker Things To Know Before You Get ThisThe Best Guide To Mortgage Broker In MelbourneMortgage Brokers Melbourne Things To Know Before You Buy

Home loan brokers can aid those who have trouble getting a home mortgage! Home mortgage brokers are flexible as well as wish to see you succeed in purchasing a home. Not only that, home loan brokers can aid whether you are buying or looking to refinance. A re-finance can be beneficial in numerous instances, like if you lately did some residence enhancements or intend to lower your passion rate - broker melbourne.Something virtually every residence customer watches for is affordability. Buying a residence is a huge purchase. So we recognize the desire to conserve money where you can. Collaborating with a broker suggests getting your house at wholesale and also not retail, which can aid you out on rates of interest.

Not known Factual Statements About Refinance Broker Melbourne

Eagle Home loan Company desires to help get you there. Sometimes things get in the way, and we locate that working with banks is one of those things.We are located in Omaha, NE, but assistance throughout Nebraska and also Iowa!.

When looking for a home mortgage, numerous home purchasers enlist the solutions of a Home mortgage Specialist. There are several benefits to making use of a Mortgage Broker and also I have put together a list of the top 8: 1. Conserves you time Mortgage Brokers have accessibility to multiple lenders (over 50!). They collaborate with lenders you have actually become aware of as well as loan providers you probably haven't heard of.

The smart Trick of Melbourne Broker That Nobody is Discussing

2. mortgage broker in melbourne. Saves you cash Home loan Brokers, if they succeed, have actually access to marked down prices. As a result of the high quantity that they do, lending institutions make offered affordable prices that are not offered directly through the branch of the lending institution that you go to. 3. Conserves you from coming to be stressed! It can be extremely difficult to discover a home mortgage.Your Home loan Broker will certainly ensure all the documents remains in location. They will keep in great interaction with you to ensure that you recognize what is going on with your mortgage and also will certainly keep you up to day with any issues to make sure that there are not a surprises. 4. Offers you access to loan providers that are or else not readily available to you Some lenders function exclusively with Home mortgage Brokers.

5. Providers are cost-free Home mortgage Specialists are paid by the lender and also not by you. This is not a downside to you. A great Mortgage Broker will certainly constantly have the ideal rate of interest of the client in mind because if you, as a client, enjoy, you will certainly go tell your buddies concerning the service you have actually obtained from the Mortgage Professional you collaborate with.

Refinance Melbourne for Beginners

6. Take on every challenge As Home mortgage Specialists, we see every situation around as well as function to make certain that every client knows what is available to them for funding choices for a home loan. Harmed credit history and also low household earnings could be a deterrent for the bank, yet a Home loan Professional knows just how to come close to the lender as well as has the partnership to make certain every client has a plan as well as technique in position to make certain there is a mortgage in their future.

8. The Home loan Broker has a much better understanding of what home loan products are offered than your financial institution Interestingly, a Home Loan Broker needs to be accredited and also can not review home mortgages with you unless they are accredited. This is unlike the bank who can "inside train" their staff to offer the specific items available from their financial institution. https://azlocaldirectory.com/mortgage-broker/unicorn-financial-services-springvale-victoria/.

Loan Broker Melbourne Fundamentals Explained

While this is not an exhaustive checklist on the benefits of using a have a peek here Home loan Expert, it is engaging to see the benefits of utilizing a Mortgage Specialist instead than placing a home mortgage together by yourself (https://azbusinesslist.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). At Ascendancy Financing Centres, we have an excellent connection with the loan providers we introduce our customers to.

We are always expert and also we constantly ensure our clients recognize every viable choice they have for mortgage funding.

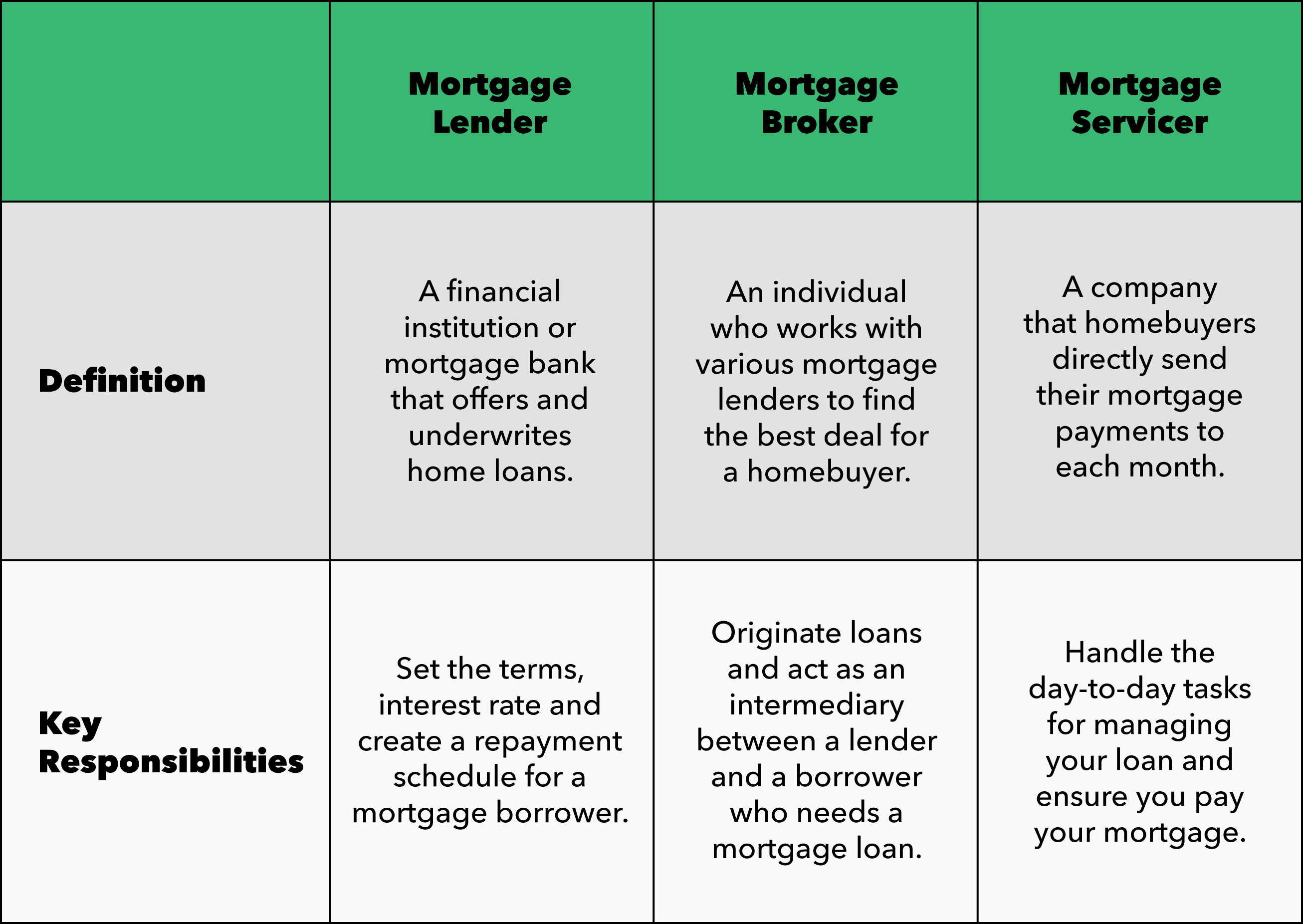

A home loan broker can help if you desire assistance sifting via car loan choices, identifying the most effective rate of interest or getting over intricate loaning difficulties. You can go shopping for a residence lending on your very own, a home loan broker serves as a matchmaker to connect you with the ideal lender for your requirements - mortgage brokers melbourne. A mortgage broker, unlike a mortgage lending institution, does not fund car loans however instead aids you discover the appropriate lending institution for your economic situation. Mortgage brokers are accredited and also controlled monetary specialists who function as a bridge in between customer as well as lender. A broker can have accessibility to a range of loan providers, which might offer you a bigger option of products and terms than a straight lender.

Unknown Facts About Melbourne Mortgage Brokers

Brokers can originate financings and also take care of the approval procedure, which can conserve you time, however they do not close home loans themselves. After you select a suitable lender, your broker will certainly assist you assemble your paperwork, send it to an expert and also order a house assessment. Once you are cleared to close, the mortgage broker will certainly start to plan for shutting day.Report this wiki page